All Categories

Featured

Table of Contents

- – Estate Planning With Life Insurance Buena Park, CA

- – Harmony SoCal Insurance Services

- – Blue Cross Blue Shield Health Insurance Plans ...

- – Health Insurance Plans Individuals Buena Park, CA

- – Term Insurance For Seniors Buena Park, CA

- – Planning Life Insurance Buena Park, CA

- – Blue Cross Blue Shield Health Insurance Plan...

- – Best Individual Health Insurance Plans Buena...

- – Estate Planning With Life Insurance Buena Pa...

- – Single Health Insurance Plans Buena Park, CA

- – Estate Planning Life Insurance Buena Park, CA

- – Seniors Funeral Insurance Buena Park, CA

- – Life Insurance Planning Buena Park, CA

- – Harmony SoCal Insurance Services

Estate Planning With Life Insurance Buena Park, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

https://maps.google.com/maps?ll=33.823884,-117.830838&z=16&t=h&hl=en&gl=US&mapclient=embed&cid=276141583131225364

Inquiries? We more than happy to help you every step of the means.

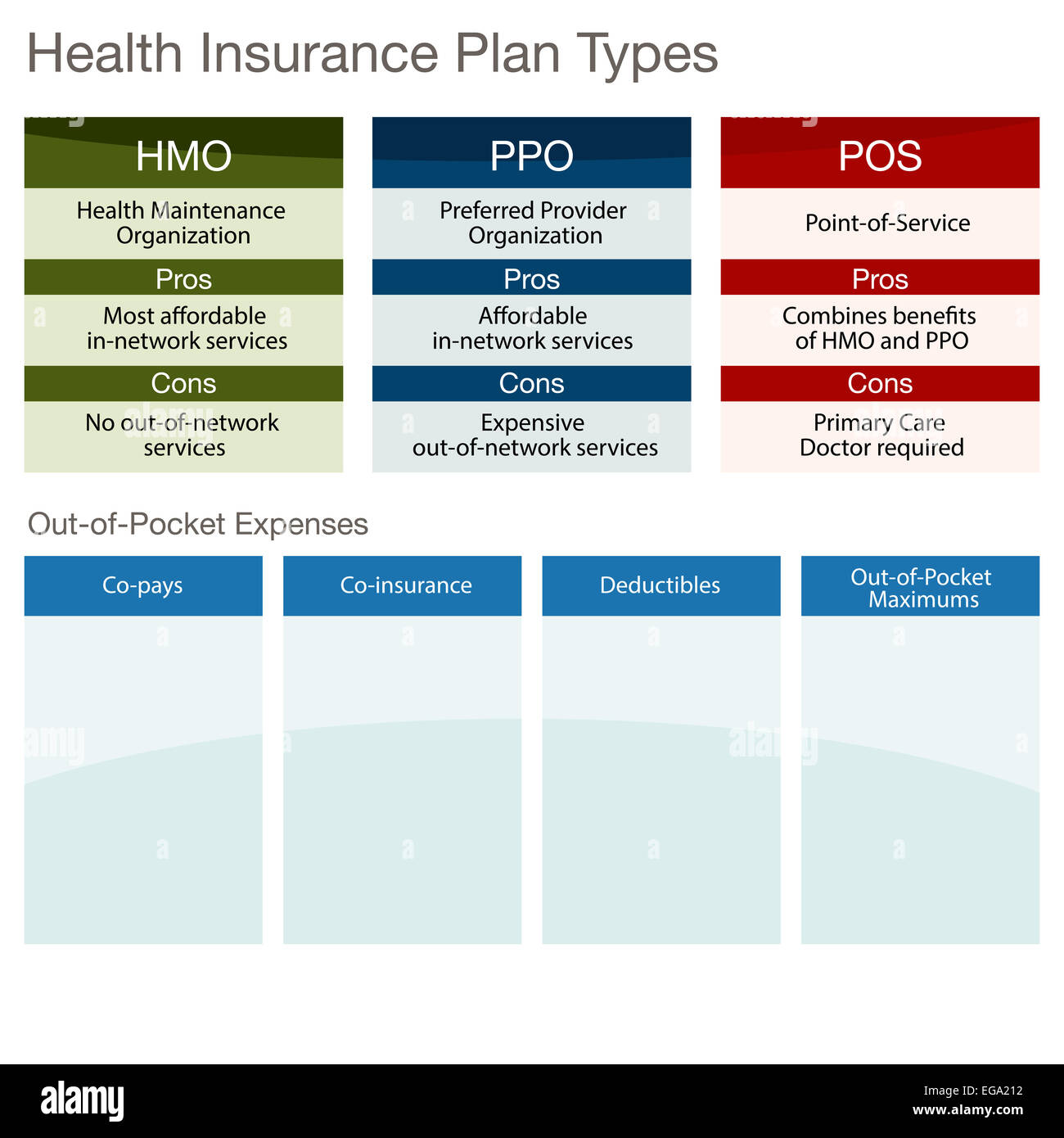

Since there are several kinds of health and wellness strategies, you must be sure to seek the one that fits your needs. Extensive medical insurance gives advantages for a broad series of healthcare services. These health insurance plan offer a breakdown of health advantages, might limit your costs if you get services from among the providers in the plan's network, and typically call for co-payments and deductibles.

Blue Cross Blue Shield Health Insurance Plans Buena Park, CA

You are just covered if you obtain your care from HMO's network of providers (other than in an instance of emergency situation). With a lot of HMO plans you pay a copayment for each covered solution. You pay $30 for a workplace visit and the HMO pays the remainder of the expense.

These plans have a network of preferred providers that you can make use of, however they likewise cover solutions for out-of-network service providers. PPP's will certainly pay more of the price if you utilize a provider that is in the network. Example: After copays and deductibles, the plan pays 100% of a service for a network provider but 80% for an out-of-network (OON) provider.

Major medical strategies typically cover hospital and clinical expenditures for a crash or illness. Instance: the strategy pays 80% of your healthcare facility remain and you pay the various other 20%.

Whether you choose a significant clinical plan, an HMO or a PPP, your strategy will probably have some "cost-sharing" attributes. This indicates that you share the price of care by paying component of the charge for each solution and the insurance provider pays the rest. Pick a strategy that functions best with the kind of wellness insurance coverage you believe you will use.

Health Insurance Plans Individuals Buena Park, CA

Instance, you pay $30 for a workplace see and the plan pays the remainder. A Strategy may have different copayments for different kinds of services. The copayment for a key care browse through might be $30 and copayment for an emergency clinic check out might be $150. An insurance deductible is the amount you pay before the plan begins to spend for the majority of covered services.

You pay a $2,500 deductible toward your healthcare services annually before the plan pays any type of Coinsurance is a percent of the enabled cost that you pay for a covered solution advantages. Coinsurance is a percent of the permitted fee that you spend for a protected solution. You pay 20% of the expense of a protected workplace go to and the plan pays the remainder.

Term Insurance For Seniors Buena Park, CA

The plan might allow just 10 visits to a chiropractor. The plan might exclude (not pay for) cosmetic surgery, and you will certainly pay for the whole price of service.

There are several means that you can purchase a health insurance in Massachusetts. Several individuals obtain their health plan via their area of work. For people that can't do this, there are a number of other methods to obtain a wellness plan. In Massachusetts over 70% of all employers supply medical insurance as a benefit to their staff members.

Planning Life Insurance Buena Park, CA

You can select the health insurance that is best for you from the choices used. If you are enrolled as a student in a Massachusetts university or college, you can acquire a health insurance plan through your institution. This SHIP id created for pupils and is just readily available while you are enlisted.

And the firm can't transform you down if you have a wellness condition. Often the firm will direct you to acquire their health strategy via an intermediary.

Blue Cross Blue Shield Health Insurance Plans Buena Park, CA

You can find out more at or call 1-800-841-2900 If you do not benefit a company that pays a minimum of 33% of your wellness plan costs, you may have the ability to buy a wellness plan from the Connector. These are plans offered by Massachusetts HMOs that the Port has actually chosen to have good worth.

The state and federal government provide reduced cost health insurance coverage for specific people with public health and wellness programs. When picking a wellness strategy, it is important to consider the distinctions between your alternatives.

Searching for health and wellness insurance can be frustrating, but remember, if the strategy seems as well excellent to be true, it probably is. Do not acquire a discount plan as an alternative to health insurance protection. Price cut strategies bill a regular monthly cost in exchange for accessibility to healthcare services at a decreased charge.

There are not certain consumer defenses that apply to these plans. They might not ensure any type of repayments, and they do not always pay expenditures for the exact same kinds of services that health and wellness insurance policy covers.

Best Individual Health Insurance Plans Buena Park, CA

In this way you can see in advance if the strategy is appropriate for you and your family. Ask what benefits the strategy does and does not cover, what advantages have limits; ask whether the plan covers your prescription medications; ask where you can view a list of the healthcare carriers in the strategy's network.

High out-of-pocket costs can quickly eliminate the cost savings of reduced monthly premiums. You ought to ask what is the month-to-month costs you would certainly spend for the strategy, what out-of-pocket costs will you have and whether there is an optimum, and what is the insurance deductible. Do not be deceived by fake health and wellness plans marketing on the net or through unrequested faxes or call.

Review any type of website meticulously and search for please notes such as "this is not insurance" or "not readily available in Massachusetts." Be careful of marketing that does not provide the details name and address of the insurer supplying the health plan. If the customer is unwilling to provide the specific name of the company, his/her name, where the company is located, or whether the firm is accredited, or if they are a certified insurance representative, you must just hang up.

Estate Planning With Life Insurance Buena Park, CA

You do not ever before need to offer monetary details to get a quote. Be cautious of high stress sales techniques that tell you a reduced monthly cost is a limited time offer and will certainly run out in a day or two. There is no such thing as a restricted time offer or "special" in medical insurance.

When you do discover a health insurance that resembles it satisfies your needs, check the Division of Insurance coverage website or contact us to find out if the business is certified to offer that sort of insurance policy in Massachusetts before you devote to getting the item. Be cautious not to hand out individual information or make a payment in feedback to an unsolicited fax or without examining it out initially.

Bronze strategies have the least insurance coverage, and platinum strategies have the most.

Single Health Insurance Plans Buena Park, CA

Exactly how are the strategies different? Every one pays a set share of costs for the typical registered person. The details can differ throughout plans. Furthermore, deductibles-- the amount you pay prior to your plan pays any of your health and wellness treatment expenses-- differ according to plan, normally with the least pricey bring the greatest insurance deductible.

If you see a medical professional who is not in the network, you may have to pay the full costs yourself. Emergency situation solutions at an out-of-network medical facility have to be covered at in-network prices, yet non-participating medical professionals that treat you in the hospital can bill you. This is the price you pay each month for insurance.

A copay is a flat cost, such as $15, that you pay when you get treatment. Coinsurance is when you pay a percent of the charges for treatment, for instance, 20%. These charges vary according to your plan and they are counted towards your insurance deductible. There are no case develops to submit.

Greater out-of-pocket costs if you see out-of-network medical professionals vs. in-network providersMore documents than with other strategies if you see out-of-network suppliers Any kind of in the PPO's network; you can see out-of-network physicians, however you'll pay even more. This is the price you pay monthly for insurance policy. Some PPOs might have an insurance deductible.

Estate Planning Life Insurance Buena Park, CA

A copay is a level fee, such as $15, that you pay when you get care. Coinsurance is when you pay a percent of the costs for treatment, for instance, 20%. If your out-of-network doctor bills greater than others in the area do, you may need to pay the balance after your insurance coverage pays its share.

If you make use of an out-of-network carrier, you'll need to pay the service provider. You have to file an insurance claim to get the PPO strategy to pay you back. With an EPO, you may have: A moderate quantity of flexibility to choose your health and wellness treatment companies-- greater than an HMO; you do not need to obtain a referral from a health care medical professional to see a specialist.

Reduced costs than a PPO offered by the very same insurerAny in the EPO's network; there is no coverage for out-of-network suppliers. This is the cost you pay each month for insurance coverage. Some EPOs might have an insurance deductible. A copay is a flat charge, such as $15, that you pay when you obtain care.

Seniors Funeral Insurance Buena Park, CA

If you see an out-of-network carrier you will have to pay the complete bill. There's little to no paperwork with an EPO. A POS plan blends the features of an HMO with a PPO. With POS plan, you may have: Even more liberty to select your healthcare suppliers than you would in an HMOA modest quantity of paperwork if you see out-of-network providersA primary care doctor that collaborates your treatment and who refers you to experts You can see in-network suppliers your medical care physician refers you to.

Your plan may require you to pay the amount of an insurance deductible before it covers care beyond preventive solutions. You will pay either a copay, such as $15, when you obtain care or coinsurance, which is a percent of the fees for treatment.

Besides precautionary care, you have to pay all your costs as much as your insurance deductible when you opt for treatment. You can make use of money in your HSA to pay these costs. You can establish a Health and wellness Financial savings Account to aid spend for your costs. The optimum you can contribute to an HSA in 2024 is $4,150 for people and $8,300 for households.

Go to free of charge, skilled assistance getting benefits that are ideal for you. was produced by the Wisconsin Office of the Commissioner of Insurance Policy (OCI) with the Wisconsin Division of Wellness Services (DHS) and numerous other partners. We're all devoted to helping every Wisconsinite get accessibility to cost effective wellness insurance policy.

Life Insurance Planning Buena Park, CA

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: info@hsocal.com

Harmony SoCal Insurance Services

It's the time each loss when you can register in health insurance policy for the following year. A life event (like obtaining wedded, having a child, or shedding other protection) might offer you a special registration duration.

Best Individual Health Insurance Plan Buena Park, CALife Insurance Family Plan Buena Park, CA

Affordable Life Insurance Plans Buena Park, CA

In Seo Citations Buena Park, CA

Find A Seo Optimization Buena Park, CA

Harmony SoCal Insurance Services

Table of Contents

- – Estate Planning With Life Insurance Buena Park, CA

- – Harmony SoCal Insurance Services

- – Blue Cross Blue Shield Health Insurance Plans ...

- – Health Insurance Plans Individuals Buena Park, CA

- – Term Insurance For Seniors Buena Park, CA

- – Planning Life Insurance Buena Park, CA

- – Blue Cross Blue Shield Health Insurance Plan...

- – Best Individual Health Insurance Plans Buena...

- – Estate Planning With Life Insurance Buena Pa...

- – Single Health Insurance Plans Buena Park, CA

- – Estate Planning Life Insurance Buena Park, CA

- – Seniors Funeral Insurance Buena Park, CA

- – Life Insurance Planning Buena Park, CA

- – Harmony SoCal Insurance Services

Latest Posts

Gas Water Heater Maintenance Del Mar Heights

Bradford White Water Heater Repair Leucadia

La Jolla Garbage Disposal Repair

More

Latest Posts

Gas Water Heater Maintenance Del Mar Heights

Bradford White Water Heater Repair Leucadia

La Jolla Garbage Disposal Repair