All Categories

Featured

Table of Contents

- – Children's Life Insurance Plans Tustin, CA

- – Harmony SoCal Insurance Services

- – Affordable Life Insurance Plans Tustin, CA

- – Health Insurance Plans Company Tustin, CA

- – Estate Planning With Life Insurance Tustin, CA

- – Health Insurance Plans For Family Tustin, CA

- – Life Insurance Family Plan Tustin, CA

- – Health Insurance Plans For Family Tustin, CA

- – Estate Planning Life Insurance Tustin, CA

- – Life Insurance Planning Tustin, CA

- – Single Health Insurance Plans Tustin, CA

- – Best Health Insurance Plans For Individuals ...

- – Best Individual Health Insurance Plans Tusti...

- – Health Insurance Plans For Family Tustin, CA

- – Estate Planning With Life Insurance Tustin, CA

- – Harmony SoCal Insurance Services

Children's Life Insurance Plans Tustin, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

https://maps.google.com/maps?ll=33.823884,-117.830838&z=16&t=h&hl=en&gl=US&mapclient=embed&cid=276141583131225364

The estimate is based on the cash worth amount, the expense of insurance policy, and various other variables. Testimonial it carefully. You may require to pay even more in premiums to maintain the policy essentially till the maturation day. A lot of universal life plans earn a guaranteed minimum rate of interest on the cash value.

These kinds of life insurance policy supply only specific insurance coverages: pays the equilibrium of a finance if you die prior to the finance is settled. If you currently have life insurance policy, you might not require credit rating life. Rather, you can designate several of the fatality advantages to the lender to pay the finance balance.

Affordable Life Insurance Plans Tustin, CA

An advantage of this insurance policy is that it secures funeral expenses at existing rates. Funeral insurance policy can be expensive compared to various other types of life insurance policy. The amount you pay in costs might wind up being greater than what the plan pays when you pass away. And lots of policies won't pay the full cost of the funeral if you pass away before paying a required amount.

Some of the most usual bikers are: adds term life insurance coverage to an irreversible life plan. If you require $500,000 well worth of complete coverage, you might purchase a $100,000 whole-life plan with a $400,000 term life motorcyclist.

Health Insurance Plans Company Tustin, CA

This biker is usually only available to individuals younger than 60. You need to have an incurable ailment, defined disease, or long-lasting care health problem.

supplies term life insurance policy for your partner. Estate Planning Life Insurance Tustin. Essentially, this biker incorporates two policies right into one. gives term life insurance policy for your youngsters. Most firms require the kid to be at the very least 2 week old. Protection generally lasts up until the youngster transforms 21 or 25. Some companies and other groups use life insurance policy as a perk.

Estate Planning With Life Insurance Tustin, CA

The majority of group life insurance policy is term life, yet some teams supply permanent life plans. Various other group plans cover the death benefit at a set amount, such as $100,000 for a term life plan and $50,000 for permanent life.

If you get life insurance via your employer, protection usually finishes when you leave your job. Common options include: The insurance policy business keeps the death benefit and pays the rate of interest to your recipient at regular intervals.

If a company refutes repayment, it should return the costs to your beneficiary. The company may also examine the cause of death. During the very first 2 years of a policy, companies generally will not pay the survivor benefit if the cause of fatality is self-destruction. If the business doesn't pay the advantage, it needs to return the costs to your recipient.

Your policy will certainly have a brand-new contestable duration if it expires and you later on reinstate it. Most policies have a 31-day poise period after your premium's due date.

Health Insurance Plans For Family Tustin, CA

This suggests you no longer have insurance coverage and your beneficiaries will not get the survivor benefit when you die. You can typically renew an expired policy. To do this, you'll have to pay the past due costs with passion. A lot of firms will certainly restore a plan within a five-year duration. To reinstate a policy, you could need to answer health concerns or take a medical examination.

Speak with your agent about the coverages and quantities you need. Consider just how much you'll need to assist your dependents after your death. Your company must tell you specifically how much your policy will certainly set you back. If you're not alright with the cost, ask the firm if they have a different plan.

During this time, you might cancel the policy for any type of reason and get a complete refund. Use this moment to be sure the coverage is right for you. Agents frequently use charts to reveal exactly how a plan's money worth could expand. These are normally estimates and aren't a promise of a policy's efficiency.

Ask for a background of the actual development of cash money values. Representatives can't offer you a present or a discount rate on a financial investment or finance to urge you to acquire life insurance coverage. If you believe an agent has made an inappropriate offer, call our Consumer Customer service. View: Exactly how to buy life insurance policy You need to review your life insurance policy every few years to make certain it still satisfies your demands.

Life Insurance Family Plan Tustin, CA

The legislation takes into consideration a death benefit to be compensation for a beneficiary's loss, and not revenue. Beneficiaries seldom pay income or inheritance taxes on a life insurance coverage death advantage. If you do not name a recipient, or your beneficiary is dead, the company will pay the fatality advantage to your estate.

A policy's money worth and death benefit are typically exempt from: creditors. Often you might need to offer your life insurance coverage policy to get cash. A life insurance coverage policy is individual residential or commercial property.

Health Insurance Plans For Family Tustin, CA

To do this, a physician must accredit that you have 2 years or less to live. You do not have to pay tax obligations on earnings from a life negotiation. You additionally may intend to market your plan if you outlast your retirement cost savings and require to pay living costs. You'll probably have to pay taxes accurate you make from the sale.

For a list of signed up life negotiation suppliers and brokers, call our Customer Customer service at 800-252-3439. If your plan has a cash worth, you can withdraw from it or pay your policy in. When you cash a plan in, you terminate it and get the money built up in the cash money value.

If you don't pay back the funding, it will reduce the amount of the survivor benefit. A plan with an accelerated survivor benefit will pre-pay all or some of the survivor benefit before you die. You should have a terminal disease, specified disease, or long-lasting care illness.

Estate Planning Life Insurance Tustin, CA

You may also take into consideration life insurance coverage as a feasible strategy to leave a philanthropic legacy for a cause you support. This component of the process can be intimidating for many individuals, but it need not be. Take a quick photo of your financial resources and respond to the complying with three critical inquiries: 1.

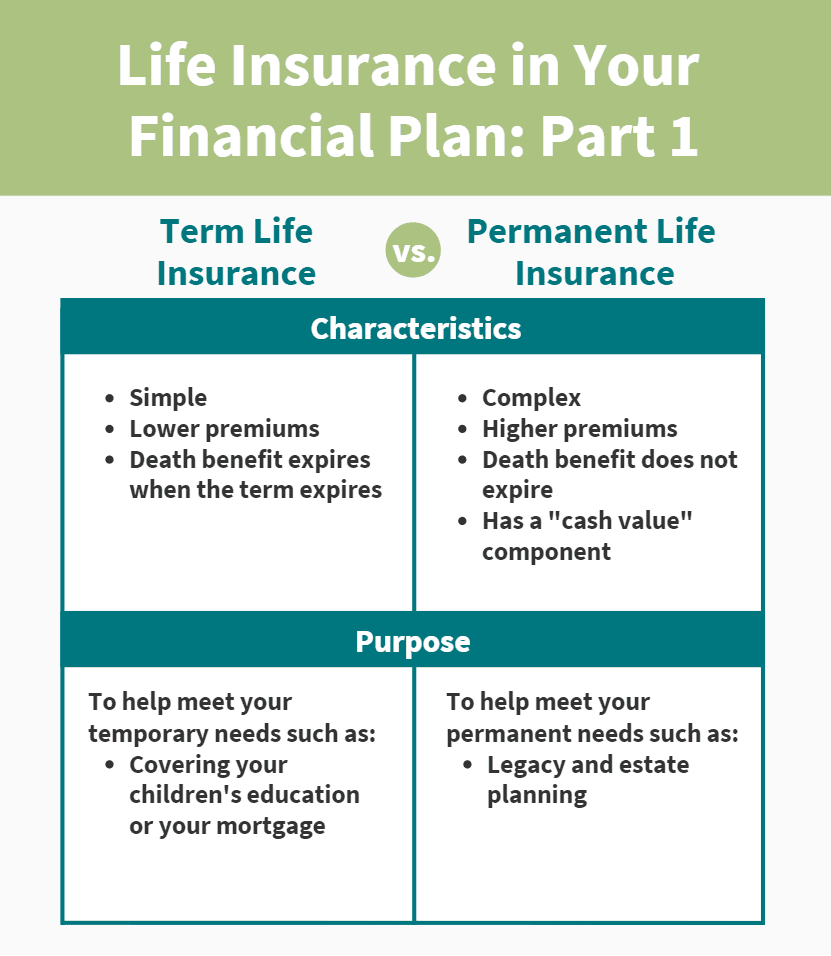

Each of these includes essential distinctions. Take into consideration how these distinctions may help you. Term life policies use repayment of a defined survivor benefit for a specific regard to your life, such as 5, ten, 15, or 20 years. Term life insurance policy protection for lots of people tends to include reduced costs; nevertheless, the longer the term, the a lot more expensive your premiums may be.

It might be more affordable to pay yearly as frequently there may be a fairly large added fee for paying in installments. Decided what works ideal for you - Estate Planning Life Insurance Tustin. As soon as the plan is acquired, tell your beneficiaries which company released it, where to locate the paper duplicate of the policy, and any specifics about what you want them to do with the survivor benefit

Life Insurance Planning Tustin, CA

These funds can aid your enjoyed ones pay living expenditures, remain in their home and settle financial obligations, including final costs. It can also help send a kid to college or leave a legacy.

SCI is not affiliated with MetLife, and the solutions offered by Self-respect Memorial members are different and apart from the insurance offered by MetLife. Planning solutions, professional help, and bereavement traveling services are offered to anyone no matter of affiliation with MetLife.

Single Health Insurance Plans Tustin, CA

Providers are not available in all territories and are subject to regulative approval. Not offered on all policy kinds. Included with Supplemental Life Insurance Policy.

Impressive loan quantities do not join the rate of interest attributed to the interest-bearing account and can have a permanent impact on certification values and advantages. Upon surrender, gap, or situation termination, including those scenarios where termination of the group contract causes termination of individual certificates/policies, car loans become withdrawals and might become taxable to the certificate proprietor.

It's crucial to look at all aspects when assessing the general competition of rates and the worth of life insurance policy protection. 14 Prior to the effective day, the employee will certainly be able to decide out of vehicle enrolled insurance coverage.

Best Health Insurance Plans For Individuals Tustin, CA

:max_bytes(150000):strip_icc()/Life-Insurance-a8aee8e3024145a8b454ea19df030418.png)

Absolutely nothing in these materials is planned to be guidance for a specific scenario or individual. Please talk to your own advisors for such guidance. Like the majority of team life insurance policy plans, insurance coverage used by MetLife include particular exemptions, exemptions, waiting periods, decreases, constraints, and terms for keeping them active.

This policy design is for the consumer who requires life insurance however want to have the ability to select just how their cash money value is spent. Variable plans are underwritten by National Life and dispersed by Equity Providers, Inc., Registered Broker/Dealer Affiliate of National Life Insurance Policy Firm, One National Life Drive, Montpelier, Vermont 05604.

Insurance coverage plans and/or linked bikers and functions might not be available in all states. Fundings and withdrawals will minimize the death benefit, cash surrender worth, and might cause the plan to gap.

Aspire is offered via life insurance coverage plans with the John Hancock Vigor Program. Products or solutions supplied under the Vigor Program are not insurance coverage and go through change. There might be additional expenses connected with these services or products and there are additional needs linked with involvement in the program.

Best Individual Health Insurance Plans Tustin, CA

Lesser amounts are offered in increments of $10,000. Under this strategy, the chosen insurance coverage takes effect 2 years after registration as long as premiums are paid throughout the two-year duration.

Coverage can be prolonged for as much as 2 years if the Servicemember is totally disabled at separation. SGLI insurance coverage is automatic for most active service Servicemembers, Ready Book and National Guard members set up to carry out a minimum of 12 periods of inactive training per year, members of the Commissioned Corps of the National Oceanic and Atmospheric Administration and the Public Health and wellness Service, cadets and midshipmen of the U.S.

VMLI is readily available to Experts that received a Specifically Adjusted Real Estate Grant (SAH), have title to the home, and have a home loan on the home. SGLI protection is automatic. All Servicemembers with permanent insurance coverage need to make use of the SGLI Online Registration System (SOES) to assign beneficiaries, or decrease, decline or recover SGLI protection.

All Servicemembers should make use of SOES to decline, minimize, or restore FSGLI coverage.

The Federal Federal government established the Federal Employees' Group Life Insurance Policy (FEGLI) Program on August 29, 1954. It is the biggest team life insurance policy program in the world, covering over 4 million Federal staff members and senior citizens, along with several of their member of the family. The majority of workers are eligible for FEGLI insurance coverage.

Health Insurance Plans For Family Tustin, CA

It does not construct up any kind of cash money worth or paid-up worth. It includes Fundamental life insurance coverage and three alternatives. In many cases, if you are a brand-new Federal worker, you are instantly covered by Standard life insurance policy and your pay-roll office deducts costs from your income unless you forgo the protection.

Unlike Fundamental, registration in Optional insurance is not automated-- you should take action to elect the alternatives. The price of Fundamental insurance policy is shared in between you and the Government.

You pay the full cost of Optional insurance, and the cost relies on your age. The Workplace of Federal Worker' Team Life Insurance Policy (OFEGLI), which is a private entity that has an agreement with the Federal Government, processes and pays claims under the FEGLI Program. The FEGLI Calculator enables you to identify the face worth of numerous combinations of FEGLI insurance coverage; compute costs for the various mixes of insurance coverage; see exactly how picking various Choices can change the amount of life insurance policy and the premium withholdings; and see exactly how the life insurance policy lugged into retirement will certainly change over time.

Estate Planning With Life Insurance Tustin, CA

For J.D. Power 2024 award information, visit Permanent life insurance develops cash money value that can be borrowed. Policy lendings accrue rate of interest and unpaid policy loans and interest will certainly decrease the survivor benefit and money value of the policy. The amount of cash worth readily available will generally depend upon the type of long-term policy acquisition, the amount of protection purchase, the length of time the policy has actually been in pressure and any type of exceptional plan car loans.

This is just a general description of coverage. A total statement of protection is located only in the policy. Insurance plan and/or connected bikers and features may not be available in all states, and policy terms may differ by state. Neither State Ranch nor its agents give tax obligation or legal recommendations.

. Typically, the more youthful and much healthier you are, the more budget friendly your life insurance can be beginning at simply $32 per month via eFinancial. * Coverage alternatives begin at $5,000 and rise to $2 million or more through eFinancial. With Progressive Life Insurance coverage Company, insurance coverage options array from $50,000 to $1 million.

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: info@hsocal.com

Harmony SoCal Insurance Services

Have extra inquiries? Progressive Responses is your source for all things insurance. See all our life insurance policy pointers and sources.

Best Individual Health Insurance Plans Tustin, CASingle Health Insurance Plans Tustin, CA

Best Health Insurance Plans For Individuals Tustin, CA

Close To Seo Packages Tustin, CA

Find A Seo Service Tustin, CA

Estate Planning Life Insurance Tustin, CA

Harmony SoCal Insurance Services

Table of Contents

- – Children's Life Insurance Plans Tustin, CA

- – Harmony SoCal Insurance Services

- – Affordable Life Insurance Plans Tustin, CA

- – Health Insurance Plans Company Tustin, CA

- – Estate Planning With Life Insurance Tustin, CA

- – Health Insurance Plans For Family Tustin, CA

- – Life Insurance Family Plan Tustin, CA

- – Health Insurance Plans For Family Tustin, CA

- – Estate Planning Life Insurance Tustin, CA

- – Life Insurance Planning Tustin, CA

- – Single Health Insurance Plans Tustin, CA

- – Best Health Insurance Plans For Individuals ...

- – Best Individual Health Insurance Plans Tusti...

- – Health Insurance Plans For Family Tustin, CA

- – Estate Planning With Life Insurance Tustin, CA

- – Harmony SoCal Insurance Services

Latest Posts

Gas Water Heater Maintenance Del Mar Heights

Bradford White Water Heater Repair Leucadia

La Jolla Garbage Disposal Repair

More

Latest Posts

Gas Water Heater Maintenance Del Mar Heights

Bradford White Water Heater Repair Leucadia

La Jolla Garbage Disposal Repair